Table of Content

Confidential or time-sensitive information should not be sent through this form. If police suspect you of abandoning or endangering a child, you should contact an attorney before talking to a detective or an officer. This is the single most important thing to remember if you are accused of a crime. Most people don’t realize that police are allowed to lie to you and are trained to elicit the answers they want from a suspect.

The Texas Penal Code also makes it a criminal offense to leave a child alone in a vehicle under certain circumstances. A conviction could have a permanent impact on your life, as well as the life of your child. Contact a Texas defense attorney today to learn more about the charges against you and potential defenses.

How does LegalMatch work?

It’s also likely that Child Protective Services will become involved in the investigation. Again, it’s important to consult an attorney before talking to CPS. Anything you say to CPS will be given to law enforcement and can potentially be used against you and could also jeopardize custody of your children.

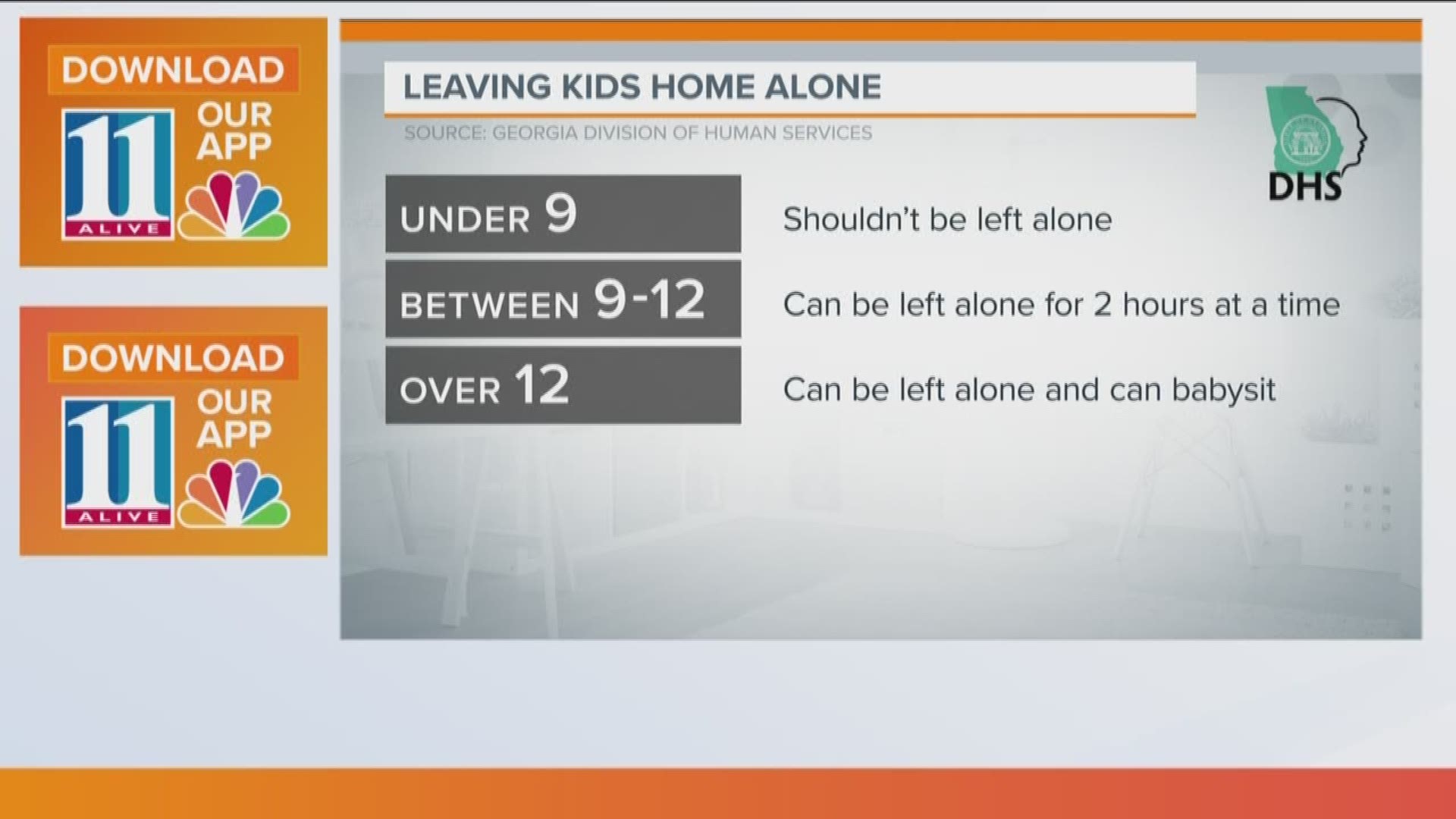

However, there are circumstances in which a parent can face significant civil consequences and even criminal charges for leaving a minor child home alone. It`s important to know your state`s policies for leaving your child home alone. While you may think they`re ready, it`s still not legal to leave them alone without adult supervision. Each state differs in consequences, but most implement fines and/or jail time. In addition to the suggestions listed above, it`s always a good idea to let your immediate neighbors know that some days your child may be home alone. Not only can a neighbor be a good resource in an emergency, but they can also help mitigate potential calls to parental control services from ignorant neighbors.

Can My Employer Require Proof of Vaccination?

Neither federal law nor Texas law requires private sellers to keep a record when they sell a firearm. FFL dealers are required to keep records of their sales, but these requirements do not apply to private sellers. Even though it is not required by law, you may want to keep a record of the sale for your own purposes. See this ATF brochurefor best practices to follow when selling a firearm. For parents, leaving a child home alone can be a difficult decision.

Readers with legal problems, including those whose questions are addressed here, should consult attorneys for advice on their particular circumstances. In addition to leaving a child at home, “Sherin’s Law” would also make not reporting a child as being missing within a few hours a felony as well. Other states have adopted similar laws, but currently, Texas does not. Simple abandonment is a state jail felony punishable by six months to two years in state jail and a fine. Texas law makes allowances for certain parental errors in judgment. Punishment for abandoning or endangering a child are on a sliding scale based on the seriousness of the charge.

ASK YOUR CHILD...

Please see theMask Laws pageof ourCOVID-19 & Texas Law guidefor more information on finding current state and local orders regarding face coverings and masks. You can read these laws in Chapter 2, Subchapter C of the Texas Family Code or by visiting the Conducting the Ceremony page of our Marriage in Texas guide. Austin Tenants' Council has created a page about Repair Rights with instructions for requesting repairs under this law. They also offer a free Self-Help Repair Kit with form letters and instructions that you can use to notify your landlord. If private sellers want to make a sale across state lines, they must get help from an FFL dealer in the state where the buyer lives. From Cumberland School of Law and has been a member of the Alabama State Bar since 2012.

For more information, please see the Mask Laws page of the COVID-19 & Texas Law research guide. KP-0257, a 2019 opinion on whether a county contracting with a private entity for the collection of money owed to the county can charge a fee to defendants. See these FAQ pages from the ATF for information about what makes someone a "resident" in a state and for information about people who have a home in more than one state. See our Gun Laws research guide for information on who is prohibited from possessing a firearm in Texas. See the handbookfor more detailed information about when you need a Federal Firearms License to conduct firearm sales.

Depending on the circumstances and the age of a child, leaving a child alone at home or in a vehicle can lead to an arrest and serious consequences. In Texas, charges that could stem from leaving a child alone or in harms way include abandoning a child, endangering a child, or leaving a child in a vehicle. Abandoning and endangering are two separate felony offenses that apply to children under the age of 15.

The court must also find that the individual, such as the neighbor, intends to establish a sincere, loving, parent-child relationship with the child. The relative or neighbor must show the court that they understand the rights and responsibilities of becoming the parent of the child. If abandonment occurs, a child may be permanently removed from the home. Permanently removing a child from a home requires a court order. A family court judge who orders the removal may order that the child be placed with a relative or neighbor if the court finds it in the best interest of the child to do so. A child ages 16 to 17 can be left unsupervised for up to 2 days.

The Texas Controlled Substances Act (Health and Safety Code, Ch. 481) defines marijuana (spelled "marihuana") and sets criminal penalties for possession, delivery, and delivery to a child. The Texas Department of Public Safety regulates dispensaries authorized by the Compassionate-Use Act. DPS has provided answers to frequently asked questions about the Compassionate-Use Program on their website. Cannabidiol is a substance derived from the cannabis plant that does not have the same psychoactive properties as tetrahydrocannabinol . This article from the Harvard Health Blog provides more details about what cannabidiol is.

Of course, unlike Home Alone, real-life parents don’t leave their kids unintentionally. In 2019, Texas House Bill 1325 passed during the 86th Regular Session and was signed by the governor on June 10th, 2019. This bill amended the Texas Agriculture Code and the Health & Safety Code in order to regulate the growth of industrial hemp and the sale of consumable hemp products like CBD oil. This FAQ will briefly summarize these laws, but for more information, please see the CBD page of our Cannabis and the Law guide.

Jennifer enjoyed being a Law Clerk for a distinguished Circuit Judge in Alabama. She is a stay-at-home mom and homeschool teacher of three children. Additionally, we recommend that adolescent baby sitters not watch more than two children at one time with no more than one of these children being under the age of two years. The first thing to do is remember Safety first, and providing proper supervision of children is the number one thing we can do to keep children safe.

Therefore, if you are planning to leave your child home alone you need to ensure that it is legal to do so. There are guidelines determined by each state to help avoid any safety concerns once leaving your child home alone. For example, leaving methamphetamine in a child’s presence or leaving a handgun within a child’s reach could constitute child endangerment.